Jim Rogers : "This is absolute insanity, what's going on,"

"It's not just the Fed, it's central banking. This is the first time in

recorded history that all major central banks are printing a lot of

money trying to debase their currencies. The world's floating around on a

huge artificial sea of liquidity."

"it's going to dry up. And when it dries up, we're all going to pay the price for this madness.

- in Reuters TV : Click Here to watch the full interview >>>>>

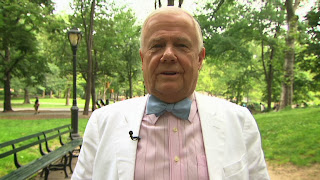

Jim Rogers started trading the stock market with $600 in 1968.In 1973 he formed the Quantum Fund with the legendary investor George Soros before retiring, a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund while the S&P 500 returned just 47%.

Jim Rogers started trading the stock market with $600 in 1968.In 1973 he formed the Quantum Fund with the legendary investor George Soros before retiring, a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund while the S&P 500 returned just 47%.

Tuesday, November 12, 2013

Jim Rogers : Bernanke will not Taper

ET Now: When do you see the FED starting to taper and whenever that happens, can emerging markets take the hit?

Jim Rogers: If and when the Federal Reserve stops or even slows down printing money, and other banks also slow down, I do not think the Japanese will slow down. Maybe the English and the European banks will. There will be a moderating affect on markets because that is where most of the money has gone.

I am not sure it (Fed slowing down money printing) is going to happen. Firstly, Bernanke will not do it while he is here (Fed Chairman) because he does not want to go out with an egg on his face. Secondly, Ms Yellen is coming in. I doubt if she is going to do it at first anyway because, a) she is keen on printing money and b) she knows what will happen when they start slowing down. So she is not going to do it anytime soon. If they do start slowing down, the markets are going to react and they (Fed) will panic and come back and say, "oh we are sorry". So, I do not see much tapering anytime soon.

The market eventually will force them (Fed) to cut back. Eventually, the market is going to say, "we do not want this garbage paper anymore, we do not want to play this game anymore". But, I do not see that happening anytime soon.

- in ET NOW : Click Here to watch the full interview >>>>>

The world is floating on a huge artificial lake of liquidity. &the liquidity has got to go somewhere

ET Now: US Federal Reserve is likely to follow loose monetary policy. Do you see this as a booster for Asian equities because in the short term, all financial markets are a function of global liquidity?

Jim Rogers: For the first time in recorded history, all the major central banks in the world are printing money at the same time. So, the world is floating on a huge artificial lake of liquidity. It (the liquidity) has got to go somewhere and most of it is going into markets. The world economies are not getting so much better but the markets are certainly much better because of all the money printing. - in ET NOW : Click Here to watch the full interview >>>>>

Jim Rogers started trading the stock market with $600 in 1968.In 1973 he formed the Quantum Fund with the legendary investor George Soros before retiring, a multi millionaire at the age of 37. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund while the S&P 500 returned just 47%.

Subscribe to:

Posts (Atom)

Jim Rogers "the 19th century was the century of the UK , the 20th century was the century of the US , the 21 st century is going to be the century of China "